More Than Half of Black Households Rent: What the 2025 Data Shows

This is a subtitle for your new post

Black homeownership remains one of the most powerful tools for building generational wealth, yet the gap continues to persist. The 2025 State of Housing in Black America (SHIBA) report, released by the National Association of Real Estate Brokers (NAREB), provides critical insight into where Black homeownership stands today and what must change.

What Is the Black Homeownership Rate in 2025?

According to the 2025 State of Housing in Black America report, approximately 44–45% of Black households are homeowners, while the majority remain renters. This data is based on U.S. Census Bureau Housing Vacancies and Homeownership Survey data.

The report also shows that the Black–White homeownership gap has widened to nearly 30 percentage points, a larger gap than when the Fair Housing Act was passed more than 50 years ago.

Why the Black Homeownership Gap Still Exists

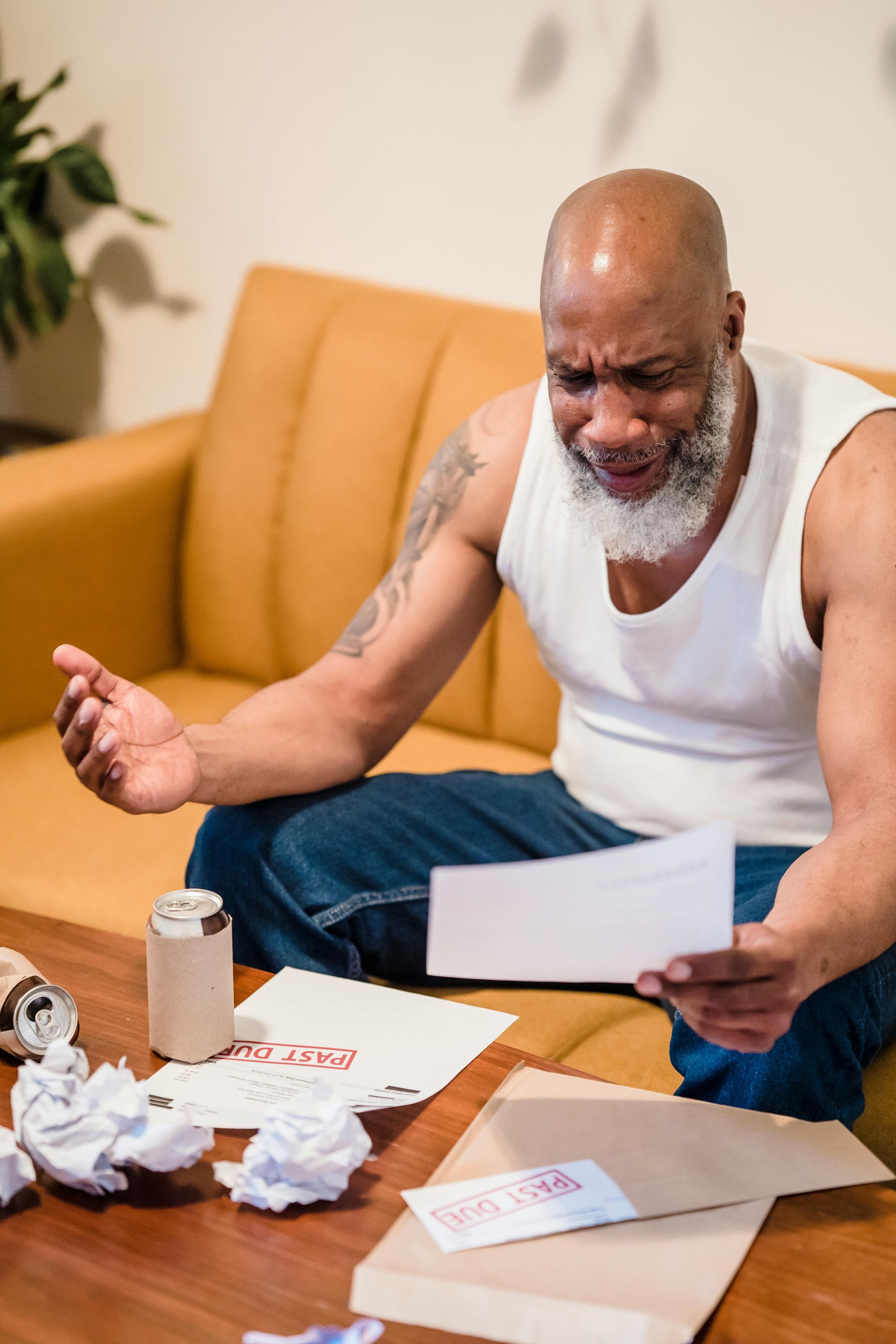

Several systemic and market-driven factors continue to impact Black homeownership:

- Housing affordability challenges caused by rising home prices and interest rates

- Income and wealth disparities that limit down payment readiness

- Credit and lending barriers, including higher denial rates and borrowing costs

- Institutional investors reducing access to affordable starter homes in many Black communities

The report further highlights that in 2024, only 7% of Black renters could afford to purchase a median-priced home, underscoring the urgency for education, access, and advocacy.

Why Black Homeownership Matters

Homeownership is more than owning a home, it is a pathway to:

- Generational wealth

- Community stability

- Economic mobility

- Long-term financial security

Expanding Black homeownership strengthens families, neighborhoods, and local economies.

Local Impact: Moreno Valley and the Inland Empire

In communities like Moreno Valley and the Inland Empire, homeownership plays a critical role in long-term financial stability. As housing inventory shifts and market conditions change, education and guidance are essential for first-time buyers, sellers, and families planning for the future.

Working with a real estate professional who understands both the local market and the historical challenges facing Black homeowners can make a meaningful difference in navigating today’s housing landscape.

The Path Forward

Closing the Black homeownership gap will require continued policy reform, fair lending practices, financial education, and community-based support. The 2025 SHIBA report serves as both a mirror and a roadmap highlighting today’s realities while pointing toward sustainable solutions for the future.

Ready to Take the Next Step?

If you are:

- A renter considering homeownership

- A homeowner thinking about selling or building equity

- A family or someone seeking guidance on long-term housing goals

Let’s start the conversation.

📞

CLICK to Schedule a consultation

📍 Serving Moreno Valley and the Inland Empire

🏡 Empowering communities through education, advocacy, and real estate expertise

Share this Post